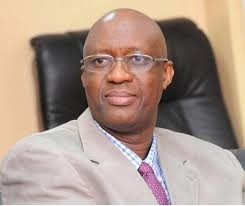

Commissioner General Yankuba Darboe, Gambia Revenue Authority (GRA) has revealed that the revenue authority will move from Automated System for Customs Data (ASYCUDA) ++ to Automated System for Customs Data (ASYCUDA) World meaning moving from Gam tax net to ITAS tax net.

In an interview held in his office on Thursday, he vowed that these two systems are “our biggest reform target for the New Year.”

Commissioner Darboe further disclosed that the government of The Gambia has tasked Gambia Revenue Authority (GRA) to collect D13.5billion for the annual revenue 2022, while in 2021 the GRA was tasked by government to collect D12. 8billion.

He did not disclosed how much GRA has collected from January to today but assured the government target will be achieve by today December 31st, as 95% of the 2021 targeted amount has been collected.

However, Mr. Essa Jallow Deputy Commissioner General and Head of Domestic Tax at GRA, expressed optimistic that beyond any reasonable doubt GRA will meet the 2021 annual target.

“Many other years have preceded 2021 but that has been the trend of all this kind, so even in instances where they find themselves in that kind of situation there will be a lot of evidences available to explain the previous performance that GRA has registered,” he said.

He noted one should not look at the revenue collection in isolation, as they operate within an economic and this economic is also affected by thing that are happening outside this country, and all this has impact on the kind of work that they do and Covid-19 is among them.

“We are creating room for police and other stakeholders like the Ministry of Finance, GIEPA, GPA and others, where the information we share with them will be available there and they will be having access to them easily without going to GRA,” Jallow disclosed.

He expressed optimistic of attaining the D12.8 billion the government tasked them to collect in 2021 and at the end of 31st December 2021, they will announce the amount collected for the year.