By Kebba Ansu Manneh

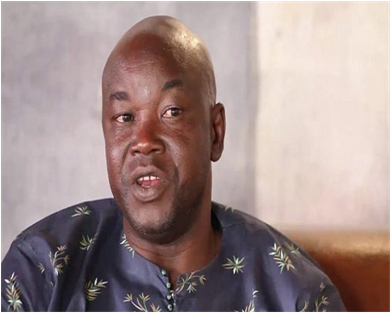

Buah Saidy, Governor of the Central Bank of The Gambia has disclosed that digital innovation has the potential to scale-up Africa’s economic development through financial inclusion, economic scale, and lower cost of the transaction.

Governor Saidy made this statement in his opening remarks at the Association of African Central Banks (AACB) 44th Ordinary Meeting of the Assembly of Governors held at Sir Dawda Kairaba Jawara International Conference Centre in Bijilo, where over forty Africa Central Banks personnel converged for the confab.

The theme for this year’s meeting is “, Digital Innovation and the future of the financial sector: Opportunities and Challenges for Central Bank Digital Currencies.

Digital innovations are transforming financial and economic landscape in Africa with the emergence of digital wallets, mobile transfers, blockchain technologies and payment systems interconnectivities.

“This has the potential of scaling up Africa’s economic development through financial inclusion, economies of scale, and lower cost of transactions. It also opens opportunities for digital currencies to be considered by central banks.

However, these evidently pose dynamic regulatory challenges to central banks and other financial institutions within the continent,” he pointed out.

According to him, the theme for this year’s convergence covers a lot of contemporary issues that are relevant to Africa’s financial sector and institutions. He noted that digital innovations are good for Africa but without doubt also come with challenges that Central Banks must be conversant with in regulating the financial sector.

Governor Saidy observed that Africa is at crossroads in its quest for development as the continent continued to experience one economic shock to another. He said while the continent started recovering from the Covid-19, its economies are again affected by another major external shock, emanating from the Russia – Ukraine war.

He added that the strong recovery anticipated for this year by many African countries is being threatened by the adverse effects of the war, highlighting that the latest forecast by the IMF painted a gloomy picture of the prospects of the global economy and downgraded its growth forecast to 3.2 percent for this year compared to 6.1 percent a year ago.

“It is now evident that low-income countries are bearing the brunt of the economic consequences of the shocks through a sharp increase in the cost of living, debt sustainability challenges, and rising external vulnerabilities. As the world gets more fragmented due to conflicts that are not our making, our efforts to confront and address climate change are diminishing,” CBG Governor highlighted.

He added: “Globally, concerted efforts are needed to tackle climate change. If the world fails to step up now, millions of people in our part of the world would be pushed into extreme poverty. Needless to say that Africa is contributing the least to global warming, but we are the most exposed and disproportionately affected by the dreadful impact of climate change.”

He recounted the recent flash floods that grappled the nation with a record 30 hours of torrential rainfall that caused severe flooding, devastated communities, and resulted in the loss of lives and property, arguing that the world must act now rather than later to address the impact of climate change.

CBG Governor continued that Central Banks have a role to play in climate change mitigation, observing that this is important for climate-related risks that have economic and financial stability implications. “Since the food crisis of 2006 that affected some countries in Africa, we have continued to witness major external shocks, including the financial and economic crisis of 2008/9, the commodities crises of 2014, the COVID-19 pandemic, and now the Russia-Ukraine war.

While the crises cited above have devastating consequences on our economies, they provide lessons and opportunities to consolidate African Solidarity, adhere to multilateralism, and shift global markets toward Africa, CBG Chief disclosed.

He added: “Being proactive is essential. We have everything in our arsenal to build economies that are robust and resilient, improve food self-sufficiency and disaster preparedness and reduce dependence on other parts of the world for survival. Improving financial inclusion that ensures that everyone is carried along is crucial and technological innovation is the engine in this regard.”

BuahSaidy finally expressed his profound appreciation to the AACB Secretariat, Board of Directors, CBG, and the Local Organizing Committee for joining forces to organize this meeting and for making it a resounding success.