By Adama Jallow

Mamadou D. Barry, IMF Resident Representative for The Gambia, has emphasised that the risks to the economic recovery from the pandemic still remain.

“The economic consequence of the war in Ukraine is already compounding the socio-economic impact of the pandemic confronting central banks in the region and around the world, leaving them with a difficult policy tradeoff between addressing elevated inflationary pressures and fostering the nascent post pandemic economic recovery,” he said.

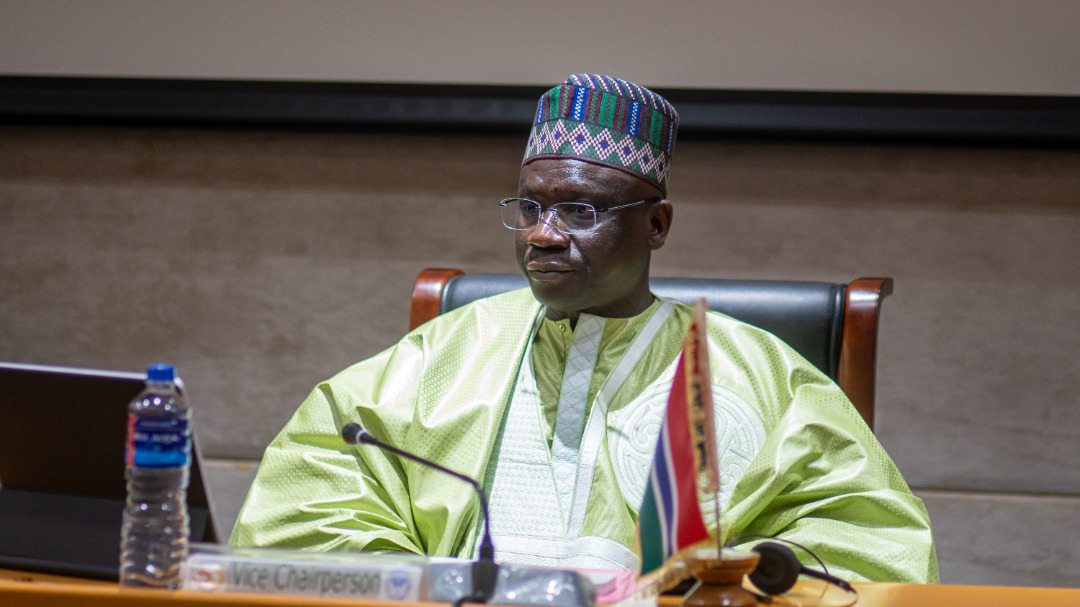

He was speaking recently at the 44th ordinary meeting of the assembly of governors organised by the Association of African Central Banks (AACB) in The Gambia.

He said successfully navigating through this difficult situation requires strong policy coordination among the institutions in charge of macroeconomic management and, most importantly, strengthening the independence of the central banks with a view to meeting their policy objectives and avoiding de-anchoring of inflation expectations that could delay the return to price stability.

The theme for the meeting is “Digital Innovations and the Future of the Financial Sector: Opportunities and Challenges for Central Bank Digital Currencies.”

Barry said it is important to note that central banks have always been at the cutting edge of financial technology and innovation.

According to him, in the past, the invention of banknotes, the processing of payments through debits and credits in book-entry accounts, and the evolution of interbank payment systems from the telegraph to internet protocols were all transformative innovations.

“Today, central banks are facing new and unprecedented challenges such as distributed ledger technology, new data analytics (artificial intelligence and machine learning), and cloud computing, along with a wider range of mobile access and increased internet speed.”

Barry said the rapid and ongoing progress in digital technologies has increased the prospect for adoption of new forms of money with the potential of transforming the financial landscape.

In Sub-Saharan Africa, the use of mobile money as percentage of the population aged-15 years and above, almost tripled between 2014 and 2021—going from 11.6 percent to 33.2 percent, he noted.

“The concept of digital money is not only diverse but also evolving swiftly,” Barry said.

It includes publicly issued central bank digital currencies, which are digital forms of fiat money fully backed by the central bank and intended as legal tender; and privately issued digital currencies or payment systems such as e-Money (like Kenya’s mobile money transfer service, MPesa).

There are also the stable-coins (which are digital tokens backed by external assets, like the USD-coin), and crypto-assets like the Bitcoin, which are not only unbacked, but are also subject to the caprices of market forces with extreme volatility to truly qualify as money, he pointed out.

“Personally, I am convinced that the use of digital currencies will continue to grow with advancements in technology and increases in digital trade both at national and transnational levels. Their adoption is already global and growing at a very fast rate, aided by the accelerated use of digital technology during the Covid-19 pandemic,” he added.

Barry also stated that the use of stable-coins, albeit very limited before the pandemic, more than quintupled in value in 2021, going from US$28.5 billion to US$158.6 billion, while crypto-assets tripled from US$763.3 billion to US$2.3 trillion.

Three African countries—Kenya, South Africa, and Nigeria—were among the top 10 in the 2021 crypto-adoption-index at the fifth, seventh, and eighth positions, respectively.

In October 2021, Nigeria became the first country in Africa and the second in the world after the Bahamas to issue a CBDC—the e-Naira, he said.

Central African Republic in April this year became the first country in Africa and the second in the world after El-Salvador to adopt the Bitcoin both as legal tender, and its official currency alongside the existing fiat currency, the CFA Franc.

For his part, Buah Saidy, Governor Central Bank of The Gambia said: “We are at crossroads in our quest for development.”

Having started recovery from COVID-19, our economies are again beset by another major external shock, emanating from the Russia – Ukraine war, he said, adding that the strong recovery anticipated this year is being threatened by the adverse effects of the war.

He said the latest forecast by the IMF painted a gloomy picture of the prospects of the global economy and downgraded its growth forecast to 3.2 percent for this year compared to 6.1 percent a year ago.

Saidy noted that it is now evident that low-income countries are bearing the brunt of the economic consequences of the shocks through sharp increase in the cost of living, debt sustainability challenges and rising external vulnerabilities.

“As the world gets more fragmented due to conflicts that are not our making, our efforts to confront and address climate change are diminishing. Global concerted efforts are needed to tackle climate change. If the world fails to step up now, millions of people in our part of the world would be pushed into extreme poverty,” he said.