By Binta Jaiteh

BakaryTrawally, the Director of Audit for Municipalities and Councils National Audit Office (NAO) has revealed that the Mansakonko Area Council has failed to provide the accounting policies in its Audited Financial Statement for 31st December 2019.

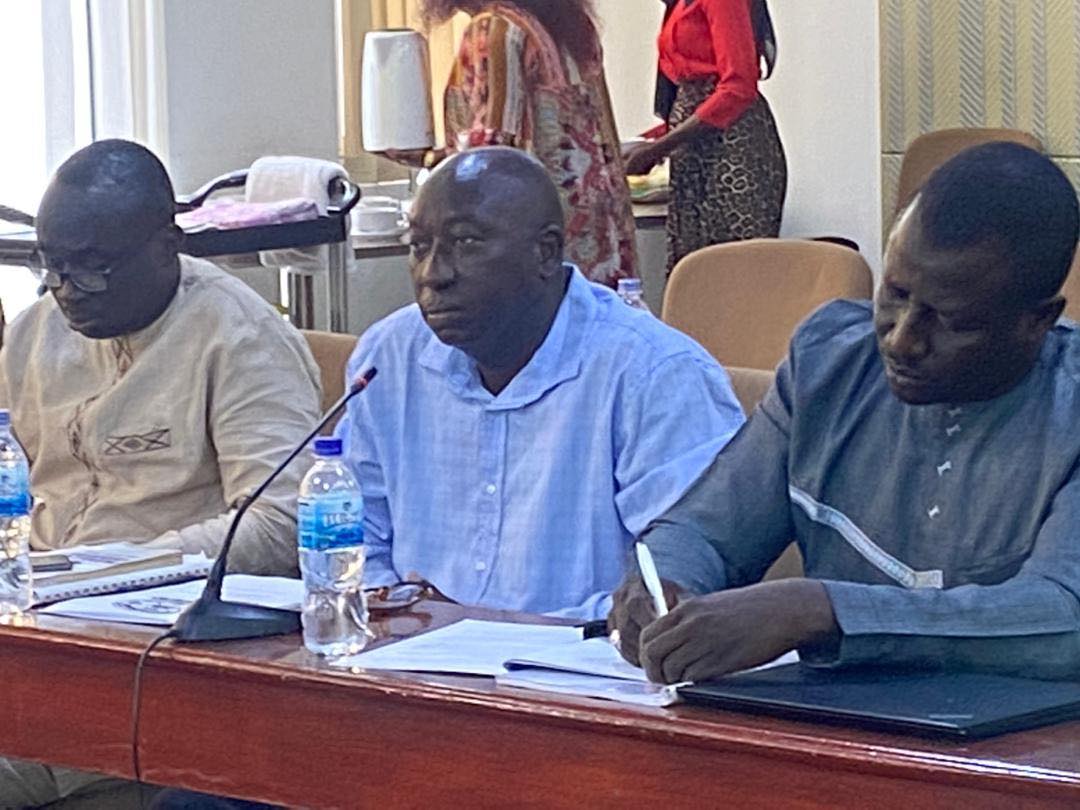

MrTrawally presenting the auditor’s report to the National Assembly Committee on Finance and Public Accounts Committee stated that they have audited the financial statement of the council which comprises the balance sheet of 31st December 2019 with the Revenue and Expenditure statement and notes to the financial statements.

In their opinion, he said the significance of the matter discussed in the basis for the adverse opinion section of their report the accounting financial statement does not present fairly the financial position as of 31st December 2019 and its performance for the year ended 2019 under the local Government act 2002 financial and accounting manual for local government 2009 and general acceptance accounting principle.

Framework and Accounting Policies adopted

He said the basis for the adverse opinion is that the council has no information on Assets and liabilities and the financial accounting manual for the local Government authorities required the preparation of a balance sheet given the basis of accounting followed by the council which is the cash basis.

This however strongly recommends disclosure of information and asset and liabilities of the reporting company within the notes of the financial statements

For this reason, the true and complete picture of the council’s standing is not available to stakeholders for decision-making, and disagreement between primary books and general balances. The cash book balance for relevant accounts had a huge difference from the corresponding code in the ledgers, he explained.

There was a cumulative deficit variance of six hundred and eighteen thousand one hundred and thirty and a cumulative surplus variance of one hundred and twenty-five thousand. There was a cumulative deficit variance of six hundred and eighteen thousand one hundred and thirty and a cumulative surplus variance of one hundred and twenty-five thousand two hundred and nineteen respectively. This difference remains unexplained and uncorrected up to the finalization of this report.

Disagreement between ledgers and trial balances

According to him, there were huge differences between notes account balance in the ledgers with corresponding balances in the trial balance, a cumulative variance of nine million one hundred and twenty-seven thousand six hundred and thirty-six and eleven million seven hundred and eighty-six thousand and forty-one dalasi nine butut for revenue and expenditure respectively existed.

However, this was not explained or corrected up to the time of finalization of the report most of the balances in both the ledger and trial balance have zero balances management did not provide any explanation.