By: The Voice reporter

The Commissioner General of the Gambia Revenue Authority (GRA) has given the assurance to the National Assembly’s Finance and Public Accounts Committee (FPAC) that the GRA Management and Staff of GRA are determined to continue facilitating the payment of taxes due to the Government in the most conducive environment and at minimal compliance cost on taxpayers.

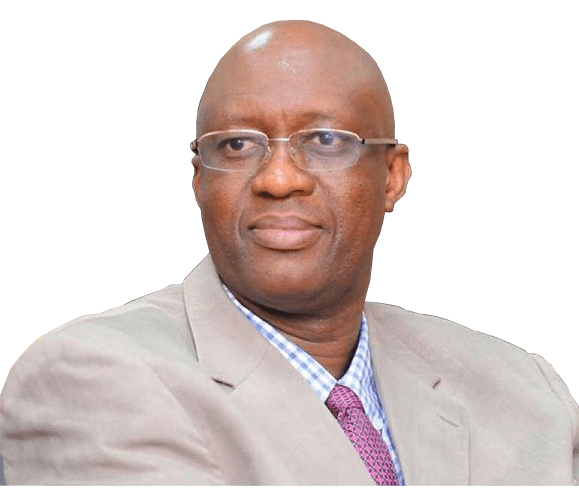

Commissioner General Yankuba Darboe made this resolution on Monday as the GRA submitted its 2021 activity report and financial statement to FPAC.

“As the revenue collecting body of government, you can rest assured that GRA Management and Staff are determined to continue facilitating the payment of taxes due to the Government in the most conducive environment and at minimal compliance cost on taxpayers. In doing so, we will continue to solicit the support of the Government and the National Assembly Members in making adequate resources available and in enacting or amending laws that can help the GRA deliver on its mandate,” CG Darboe stressed.

Accompanied by the GRA acting board chairperson, GRA board members, and representatives of GRA’s external audit department, Mr. Darboe was yesterday at the legislature to present GRA’s 2021 financial statement based on the subventions the tax authority received to run its affairs.

It could be recalled that the Finance and Economic Affairs Ministry through the Office of the Accountant General presented to FPAC the revenues collected by the GRA as part of the overall Government Revenue and Expenditure Statements.

On GRA’s 2021 activity report, CG Darboe informed FPAC that the year marked the second year of implementation of the fourth GRA Corporate Strategic Plan (2020 – 2024). He continued: “The Plan focuses on the maximization of revenue collection; strengthening the trust and confidence of the government and the public in the services being provided by the Authority; consolidating the gains already registered in HR modernization; institutional strengthening; building technical capacities in specialised areas; enhancement of IT systems used for revenue administration; and further strengthening the oversight mechanisms and M & E functions for effective implementation of the Corporate Strategy during the Plan period.”

The GRA boss informed FPAC that 2021 was a challenging year for the GRA in the area of revenue collection.

“This situation was precipitated by the advent of COVID-19 pandemic which turned out to be one of the most disruptive health emergencies to have ever hit the world. Its negative impact is beyond health as it touches on all facets of human development across countries, regions, and the world with The Gambia, not an exception,” the country’s revenue mobilization boss explained.

He went on: “On the revenue collection mandate, the GRA set a revenue performance target of GMD12,793,761,035 in 2021 which anticipated a nominal growth of 8.35 percent or D985,835,975 over the 2020 actual revenue collection of GMD11,807,925,060.95,” Darboe pointed out. This anticipated growth in revenue was premised on improved efficiency in revenue administration; the lifting of travel restrictions and opening of land borders and airspace; resumption of the tourism and hospitality industry; and the increase in demand for goods and services after COVID-19 related lock-downs in 2020.”

CG Darboe prided that GRA was able to hit its revenue target for 2021 despite the COVID-19-induced challenges. He described the development as an important milestone.

“The Authority collected a total revenue of GMD12,741,786,836.18 in 2021 which translated into 100 percent of its annual target. Compared to the total revenue collected in the corresponding period in 2020 of GMD11,807,925,060.95, the total revenue collected in 2021 represented a nominal growth of GMDD933,861,775.23 or 8 percent. The attainment of the 2021 revenue target by GRA equals the 9th time in ten years from 2012 to 2021,” he acknowledged.

Disaggregated by departments, Darboe disclosed, the Customs and Excise Department’s total revenue collection for the year 2021 totaled GMD7,093,234,506.07.

“This total collection for CED represented a 94 percent performance rate against the Department’s annual revenue target of GMD7, 538, 528,525,” the GRA boss added.

However, CG Darboe lamented that many variables had negatively affected the performance of international trade receipts in 2021. He explained: “These included the significant increase in freight charges globally (more than 200%), high international commodity prices, increased ship handling charges, COVID-19 pandemic, high duty waivers (D2.062 billion), fuel subsidies (in excess of D325 million), and the negative impact of uncertainties and speculations around the Presidential Elections. All these factors led to more than 35% drop in import volumes of essential commodities and 5% in their corresponding values on which import tariffs are applied.”

He highlighted that the shortfall against the revenue target of the year in 2021 notwithstanding, the department’s performance relatively represented a nominal growth of 5 percent or D347,119,990.06 compared to 2020.

“Similarly, the Domestic Taxes Department (DTD) total revenue collection for 2021 was GMD5,648,543,330.11, which represented D393,310,820.53 or 7 percent excess above the annual target. This represented a nominal growth of 12 percent or D586,741,785.17 when compared to the 2020 annual collection of D5,061,801,544.94. The DTD total collection equals 44 percent of the total revenue collected by the GRA in 2021,” Darboe said.

He reported though that GRA’s performance in 2021 continued to be affected by the negative impacts of the COVID-19 pandemic.

“This led to a difficult start to the year in terms of collection. The unprecedented increases in freight charges, international commodity prices, forex difficulties, and the year being an election year led to lots of speculations and uncertainties on the side of major importers all of which contributed drop in import volumes in 2021,” CG Darboe told FPAC.

He reported that despite these challenges, revenues picked up from the second quarter driven by increased receipts from fuel products and a considerable reduction in duty waivers on the side of international trade whilst domestic tax revenue growth was driven by a significant collection of tax arrears, increased collection from withholding taxes particularly from international consultants and businesses engaged through the petroleum exploratory activities, capital gains tax and stamp duties from property transactions and rental property income taxes among others.

“In addition, improved tax administrations through effective compliance management of State-Owned Enterprises (SOEs) and telecom companies, increased tax audit capacity and coverage, and data matching of third-party information all helped drive the good revenue performance of the Authority in 2021,” he acknowledged.

CG Darboe said the GRA is aware of being the focal revenue-collecting agency of Government, and the main contributor to the financing of public expenditure.

“Thus, GRA Management and staff remains ever committed to ensuring that the Authority continues to play its rightful role in the mobilization of the required financial resources for government to realise its development aspirations for the country,” CG Darboe underlined.

He reported to FPAC that the Authority continued with its ICT-based modernization of the tax system to achieve greater efficiency in customs and tax administration.

“As part of the current strategic plan, the Authority is upgrading from ASYCUDA++ to ASYCUDA World for a more efficient and effective administration of international trade by the Customs & Excise Department. Similarly, work is in progress to replace the GAMTAXNET system, currently used for the administration of Domestic Taxes with a new Integrated Tax Administration System (ITAS) to be funded by the World Bank,” he explained, adding: “Furthermore, Management continues to invest in the professionalism of our staff and encourage positive human values that contribute to the realization of our corporate goals of serving our taxpayers and the nation at large.”

Darboe recognized that the economic policies of the country and the stable political environment provide hope for the expansion of the revenue base.

“Therefore, tax administration efficiency; sound economic, political, and trade policies; and the continuous support of development partners will determine the revenue collection horizon of the Authority,” stated CG Darboe. He continued: “The foregoing highlights the link between the performance of GRA and its internal and external environments. In pursuit of the creation of the right atmosphere for increased revenue mobilization, the Authority continues to constructively engage its stakeholders within and outside the country. We have continued on the path of engaging our friends and development partners, notable among them, the IMF, the World Bank, AfDB, UNDP, AFD, WCO, GIZ, ECOWAS, ATAF, CATA, WATAF, CATA, WTO, and WHO in continually improving our systems and procedures for effective tax administration in The Gambia as well as sharing best practices.”

He recognized and thanked the Government through the Ministry of Finance and Economic Affairs for its continuous support and encouragement.

“We also wish to thank in particular His Excellency ThePresident, Mr. Adama Barrow, and his entire Government for creating the enabling environment for businesses to establish and grow and for allowing the revenue administration to effectively function without interference,” CG Darboe said.

He pointed out that the success story of GRA has been due to not only the hard work, commitment and dedication of staff and board members but also to the support of the legislators.

“Hon Chairman and Members of FPAC, Gambia Revenue Authority, as a semi-autonomous body is mandated to administer the revenue laws of The Gambia by assessing, collecting, and accounting for all revenues due to government in a fair and transparent manner; whilst providing efficient and effective systems for compliance,” the Gambia’s revenue mobilization chief explained.

He further explained that the establishment of the GRA brought together the former departments of Central Revenue (Domestic Taxes) and Customs and Excise to enhance efficiency in administration and reduce the compliance burden on taxpayers.

“The oversight responsibility of managing the affairs of GRA is reposed on a Board of Directors. To ensure that it provides a clear and consistent policy direction to the Authority, the GRA Board meets at least once every month and has set up the Staff Establishment and Finance and Audit sub-committees to support it in discharging its functions effectively and efficiently. The day-to-day running of the Authority is reposed on the Commissioner General supported by the Deputy Commissioner General and other Heads of Departments,” CG Darboe informed FPAC.