By: Momodou Justice Darboe

The Minister of Finance and Economic Affairs, Seedy Keita, has said GRA’s remarkable performance over the years has set the Authority aside as one of the most efficient institutions in The Gambia, surpassing expectations year in and year out.

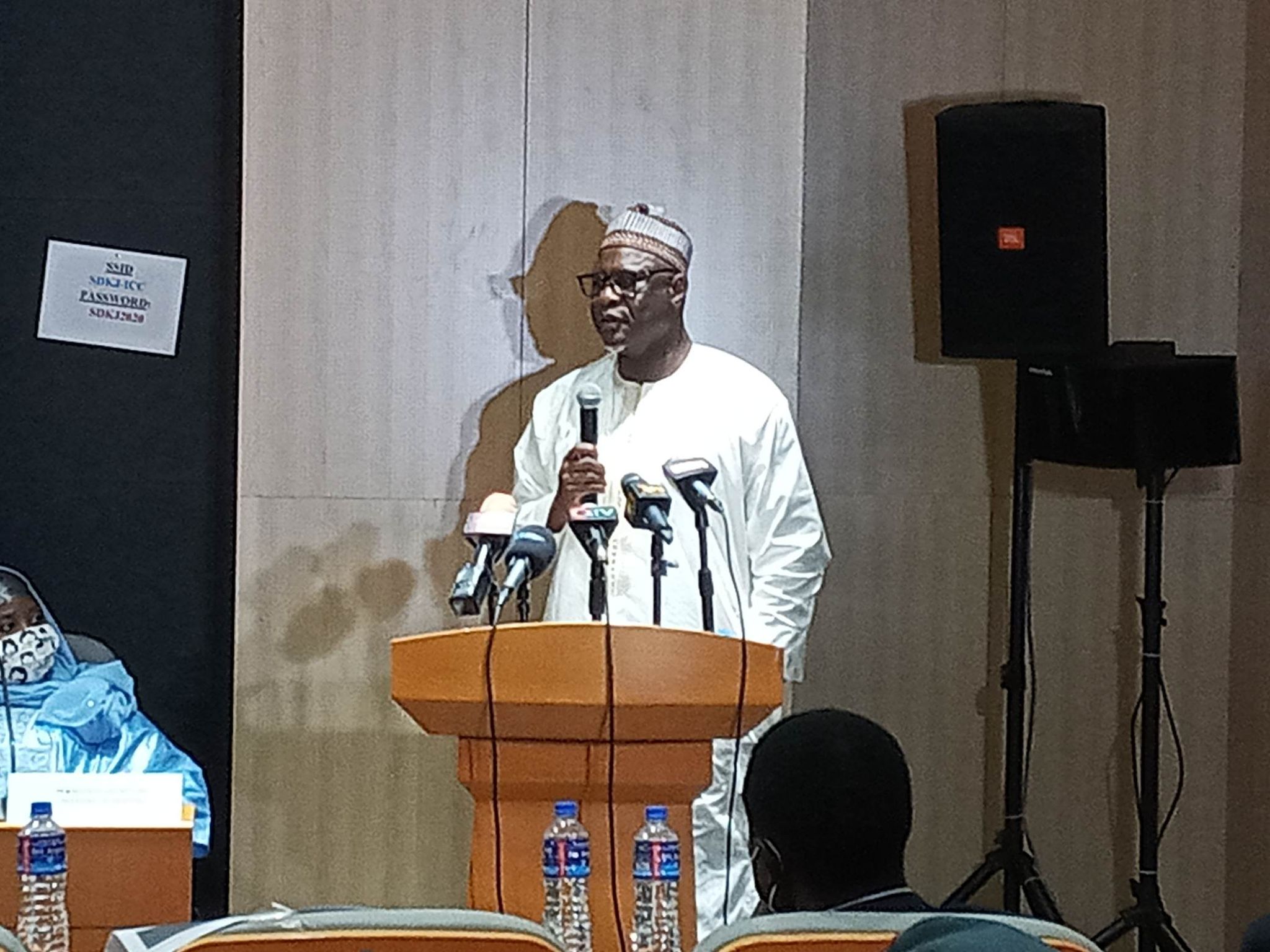

“As the Minister of Finance, I wish to use this platform to express my deepest gratitude to the GRA for its outstanding performance last year mobilizing D15.794 billion against a target of D15.21 billion. This is not only a record but marks a quantum leap from 2017 to date. If you want to get a job done, give it to a busy person. And this was achieved without increasing the tax rates (except for alcohol, gaming and cigarettes) but through enhanced compliance only,” Minister Keita acknowledged as he spoke at the 6th Edition of the GRA’s 2024 Taxpayers’ Award Ceremony held at Kairaba Beach Hotel on Saturday.

“GRA has consistently exceeded expectations, and your success in surpassing the 2023 revenue target is a testament to your dedication, hard work and commitment to our domestic revenue mobilization drive. As they say, “When you work hard, you get more work”. Building on this momentum, the government has entrusted you with a new challenge for this year, a target of D19.52 billion. I have no doubt in your ability to surpass this mark once again. We are confident in your ability to achieve this goal, given the significant investments you have made in reform processes,” added the finance minister.

According to him, the reforms spearheaded byPresident Adama Barrow, focusing on innovation and efficiency, have yielded remarkable dividends in revenue collection.

“Importantly, the government remains committed to a strategy of expanding the tax base rather than increasing tax rates, ensuring fairness and stability for all

“Looking forward, the government, through the GRA, will implement innovative processes that will support international trade and promote entrepreneurship. This, along with our focus on digitalization and IT infrastructure, aims to solidify The Gambia’s position as a hub of transit trade,” he stated.

He extended “sincere” appreciation to the GRA Board of Directors for their effective oversight and guidance which, he said, has demonstrably contributed to the GRA’s consistent success.

“I also commend the entire management and staff, alongside all stakeholders, for their dedication and contributions to national domestic revenue mobilization, especially during this period of “donor fatigue.” The government is fully committed to using taxpayer funds to further develop The Gambia, focusing on critical capital projects,” said the finance minister.

“I also want to express my gratitude to the President of the Republic for his unwavering support in our endeavors to strengthen domestic revenue mobilization.

“To the esteemed awardees, congratulations on receiving these well-deserved recognitions.Your exceptional compliance serves as an inspiration to others. Together we can do it and GRA is charting the course and we are sure the National Development agenda HE AdamaBarrow will be realized insallah,” he added.

Earlier in his speech, Minister Keita acknowledged that taxpayers’ contributions lubricate the financing of vital government programs.

“I am deeply honored to be a part of this important occasion celebrating and recognizing the most compliant taxpayers in our economy; the sixth edition. The Gambia, like many nations, is a tax-based economy. It is through the contributions of our esteemed taxpayers that we are able to fund vital government programs. In fact, if the state were an equity company, the tax-paying citizens are the shareholders,” he underlined.

“Therefore, setting aside a day to recognize the invaluable role taxpayers play in our economy is a laudable initiative. I commend GRA for conceiving this initiative,” stated the finance minister. He added: “Without a doubt, this ceremony will trigger a positive and healthy competition among our esteemed taxpayers to be recognized as one of the most compliantbusinesses or individuals in the various categories of the economy and more so to receive the awards personally from the President of the Republic, Mr. Adama Barrow. This will inevitably drive voluntary compliance among our tax base.”

According to the finance minister, the annual award ceremony serves as an important reminder that The Gambia, like many nations, is a tax-based economy, relying heavily on tax revenue to fuel the nation’s progress.

“The revenue collected by the GRA is the lifeblood of our economy, enabling us to address critical needs and uplift the living standards of our fellow Gambians,” he recognized.

“Your taxes provide the funding for government programs, capital projects and the vital services that uplift the lives of Gambians and propel us towards economic prosperity. Today, we dedicate this special day to recognize the very taxpayers who make this progress possible.

“To the esteemed members of the business community, I express my heartfelt appreciation. Your timely payments, diligent filing of tax returns, and compliance with revenue laws contribute significantly to the national coffers, allowing the government to function effectively,” he stated.