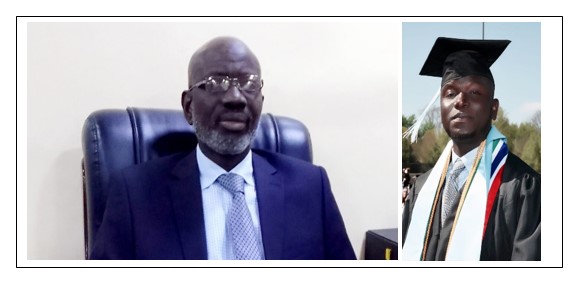

By Kemo Kanyi

Dr. Foday Joof, Risk Management Officer at the Modelling and Forecasting Unit, Economic Research Department of the Central Bank of The Gambia, said the crises around thedevaluation of Gambian dalasi, according to his ten-year research methodology, can be attributed to six factors.

Dr. Joof said the Exchange Rate Market Pressure Index (EMPI) is an early warning signalling mechanism for predicting currency crises in The Gambia using monthly data from 2002 to 2023.

He stated that the Gambian economy suffered six major currency crises during the period under review. These crises, he said, stemmed from both domestic and external shocks, with more vulnerability from domestic shocks.

“First, the currency crisis between 2002 and 2003, can be attributed to the drought that resulted in the collapse of the groundnut harvest of 2002, causing a 3% contraction of GDP in 2003. Consequently, the Dalasi (GMD) depreciated by 45% and 60% against the US dollar and Euro end December 2003, respectively,” Dr. Joof observed in an exclusive interview with The Voice.

According to him, the International Monetary Fund said this crisis was further exacerbated by poor execution of monetary and fiscal policy, reflecting serious deficiencies in governance.

He indicated that the second currency crisis was observed during the 2008 global financial crisis (GFC), explaining that the Gambian dalasi experienced various pressures in September 2008 and lasted for four months.

“This might have been triggered by the collapsed trade and capital flows brought by the GFC, which created a considerable balance of payment (BOP) gap, and eventually rapid depreciation and higher exchange rate volatility,” he added.

Dr. Joof recalled that the Dalasi experienced another crisis in January 2011.

“This was triggered by the drought of 2011-2012 that resulted in a crop failure, causing GDP to contract by 4.1 per cent in 2011 alone. Given the country’s high dependence on imports, the GMD further depreciated against the US dollar by nearly 30 per cent at the end of 2012. Moreover, this also coincided with the end of the sovereign debt crises and the onset of the Arab Spring. These events might have affected GMD via numerous channels. The ripple effects are a result of trade and investment connectedness with affected nations,” he stated.

He further stated that volatility in global commodity prices (oil prices) coupled with high borrowing costs and the decline in remittance flows to The Gambia due to economic turmoil in crisis-hit countries might have also contributed to the pressure on the GMD.

“The GMD experienced its highest peak pressure in February 2016. This pressure can be explained by an 80% decline in net foreign between January and February 2016,” explained Dr.Joof.

He recalled that prior to this period, an executive directive attempted to stabilise the GMD by pegging it against the U.S.dollar at 35-40 GMD. However, due to the low levels of foreign reserves (decline in foreign reserves by 80%), deteriorating BOP and debt servicing obligations, the peg could not be sustained and eventually collapsed (CBG, 2016), leading to the highest exchange rate crises over the sample period.

“Another crisis was observed during the peak period of the COVID-19 pandemic in December 2020. COVID-19 led to prevalent uncertainty and supply chain bottleneck, resulting in appreciation of the dollar against many currencies due to the search for safe-haven currencies,” the senior Central Bank staff said.

He also recollected that the GMD suffered another crisis in November 2022, attributable to the CBG directive to restrict the withdrawal from foreign currency-denominated accounts,which was issued in May 2022 with the hope of stabilising the already stable GMD.

“The index was at negative value months prior to the directive but suddenly became positive after the directive, indicating exchange rate pressure,” he stated, adding: “Although, the directive was rescinded three months later (September 2023), it was too late to prevent a crisis due to the uncertainties in the forex market before stabilising in the following month.”

Dr. Joof stated that the pressure on the GMD reached its peak in the 2016-election year- followed by the 2002-2023 collapsed groundnut harvest and the restriction of FCD withdrawals in 2022.

“However, these pressures mostly did not last long. On average, the market absorbs the shocks between 1-2 months,” he explained.

He recommended that monetary and fiscal authorities shoulddesist from issuing directives in an attempt to stabilise GMD, and that authorities should prioritise climate mitigation and adaptation strategies to mitigate the effects of climate-related shocks on the vulnerable sector.

Meanwhile, Dr. Joof is a sustainable finance specialist and resource economist. He is a Ph.D. scholar in finance from Eastern Mediterranean University, specialising in financial market spillovers and financial econometrics. He also has a Ph.D. in Banking and Finance from Near East University with a specialisation in banking regulation and responsible banking. Currently, a Ph.D. fellow in environmental sustainability at the University of Ottawa, Canada, focusing on resource economics.