By: Kemo Kanyi

The Governor of the Central Bank of The Gambia, Hon. Buah Saidy, said Tuesday that the Gambian economy continues its strong performance in the second quarter of 2024, with encouraging signs in the fight against inflation.

“Recent data released by the Gambia Bureau of Statistics (GBoS) indicates that the Gambian economy grew by 4.8 percent in 2023, compared to the revised growth of 5.5 percent in 2022,” he added, saying that growth was mainly supported by a pickup in the services and industry sectors, reflecting the buoyant private and public construction activities.

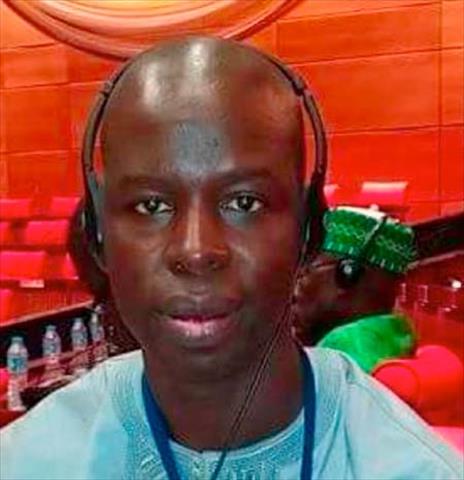

Governor Saidy, who was speaking in a press conference at the CBG conference hall, said the apex bank’s staff forecast economic growth at 5.7 percent in 2024, representing a 0.2 percentage point upward revision from the May 2024 forecast.

“Growth is anticipated to be supported by strong public and private investment spending, household consumption, and a rebound in tourism. However, significant risks continue to shroud this growth outlook including geoeconomic fragmentation, ongoing geopolitical tensions, volatility in commodity prices, and domestic climate-related risks,” the CBG boss stated.

According to the CBG boss, the Central Bank’s latest Business Sentiment Survey for the second quarter of 2024 indicated a slight improvement in business confidence.

“Most respondents expect economic activity to expand over the next three months. Despite this optimism, businesses remain concerned about inflation, with a significant portion of businesses surveyed expecting a further rise in inflationary pressures in the near term. Looking ahead, the continuous decline in inflation is expected to stabilize these expectations,” he reported.

He explained that preliminary balance of payments estimates indicate persistent external sector challenges during the review period. He added: “The current account balance deteriorated to a deficit of US$16.0 million (0.7 percent of GDP) in the second quarter of 2024, after recording a surplus of US$1.4 million (0.1 percent of GDP) in the first quarter of 2024. The goods account balance moderated somewhat to a deficit of US$244 million (11.2 percent of GDP), compared to the US$257.9 million (8.8 percent of GDP) reported in the first quarter of 2024, owing to a slight drop in imports.”

Governor Saidy told the press conference that the foreign exchange market continues to function smoothly. “Total activity volumes, measured by aggregate purchases and sales of foreign currency, in the domestic foreign exchange market stood at US$563.0 million in the second quarter of 2024, compared to US$600.9 million reported in the first quarter of 2024,” he stated.

“The decline in activity volumes is largely attributed to the lean period in tourism activities and the drop in remittance inflows. Total private remittance inflows, the largest source of foreign currency supply, slightly moderated by 1.6 percent in 4 the second quarter of 2024 to stand at US$200.9 million, compared to US$204.2 million registered in the first quarter of 2024,” Governor Saidy reported.