By Kemo Kanyi

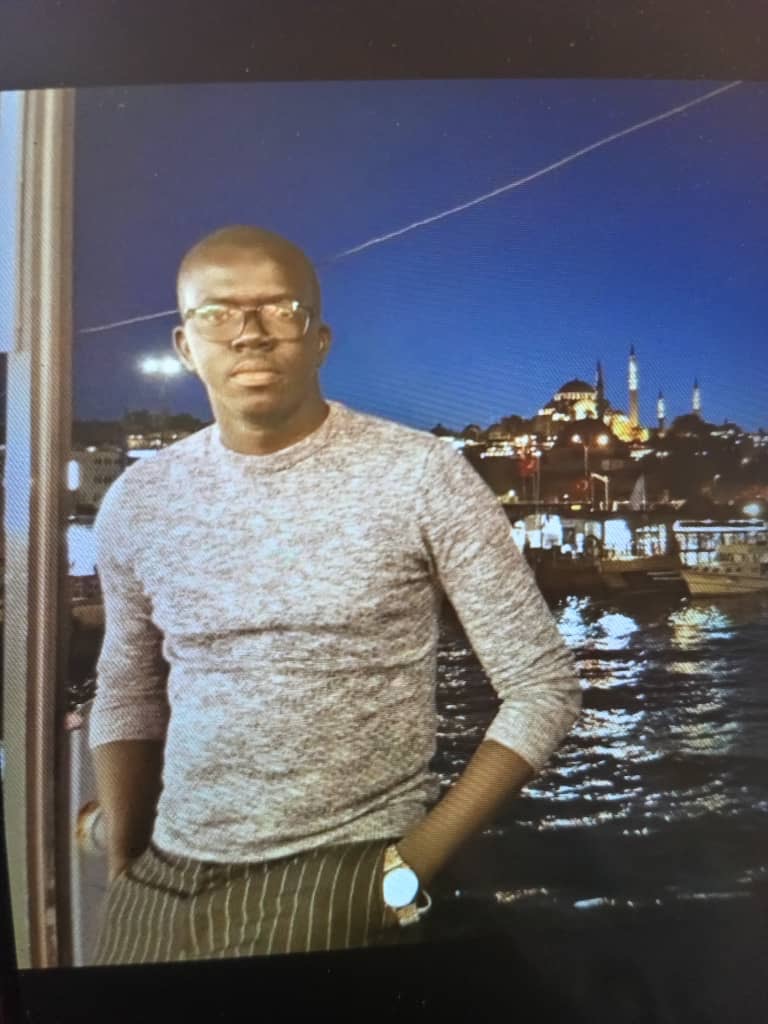

Dr. Foday Joof, a sustainable finance specialist has stressed the urgent need for The Gambia to re-think its financial system in an era of growing climate challenges, saying financial development is crucial for economic growth

Dr. Foday added that it can also serve as a double-edged sword for the environment, as it contributes to both environmental quality and degradation by either exacerbating climate shocks via credit channels to eco-unfriendly industries or mitigating them by financing eco-friendly ventures.

In an interview with this reporter, Dr. Joof indicates that The Gambia faces challenges in balancing economic growth with environmental sustainability.

“The financial system directs its credit to sectors like agriculture, industry, and services, but often without sufficient environmental safeguards,” the finance sustainable specialist stated.

Recent research by Dr. Foday Joof revealed that two out of the six currency crises in The Gambia were due to climate-related shocks (drought).

He added that climate change presents two main risks to financial stability: “physical and transition risks.”

He explained that “Physical risks arise from direct climate impacts like natural disasters (droughts, floods, and so on) which might damage infrastructure and decrease agricultural yield.”

He added that this, in turn, increases the insurance liability and default risk and decreases the profitability of corporations that rely on economic activities that depend on the ecosystem, and consequently, feedback into the financial system through non-performing loans, depreciated asset valuations, legal costs, and liquidity or via macroeconomic factors (shocks to exchange rates, and volatile commodity prices).

Meanwhile, he stated that the transition risks stem from policy, technology, and consumer changes aimed at promoting the transition to a greener economy.

“Depending on the nature, speed, and focus of these changes, transition risks may pose varying levels of financial and reputational risk to companies. These can increase costs and reduce asset values, especially in sectors that are not sustainable.” he maintained.

Dr. Joof noted that The Gambia is particularly vulnerable due to its reliance on agriculture and tourism, which are sensitive to climate variability. “Without adaptation, our industries could face declining competitiveness and increased costs.”

To address these climate-related financial risks, Dr. Joofencourages a shift in this financial thinking, “We must move away from focusing exclusively on financial returns. Our approach should integrate three principles: combining financial, social, and environmental returns, setting sustainability goals, and prioritizing long-term societal value,” he explicitly stated.

However, he threw weight on the significance of financial institutions towards an eco-friendly environment, saying “Financial institutes should finance eco-friendly projects and incorporate sustainability into their operations.”

Role of CBG in Responsible Investments

“The CBG should implement regulations to encourage financial institutions to prioritize sustainable investments. This includes the setting of guidelines for environmental, social, and governance (ESG) considerations in lending practices and promoting transparency through mandatory climate risk disclosures,” a Ph.D. fellow in environmental sustainability at the University of Ottawa, Canada, suggested.

He also called for CBG to create incentives such as access to special funding facilities, interest rate subsidies, and lower capital requirements for financial institutions that support green projects.

“By taking a proactive approach, the CBG spurs a financial system that aligns with national sustainable development goals,” Dr. Joof argued.