By: Momodou Justice Darboe

The Gambia Revenue Authority (GRA) is leaping towards hitting the D19.2 billion revenue target set for it by the Gambia government as the country’s main revenue mobilization agency collected D13.8 billion in eight months.

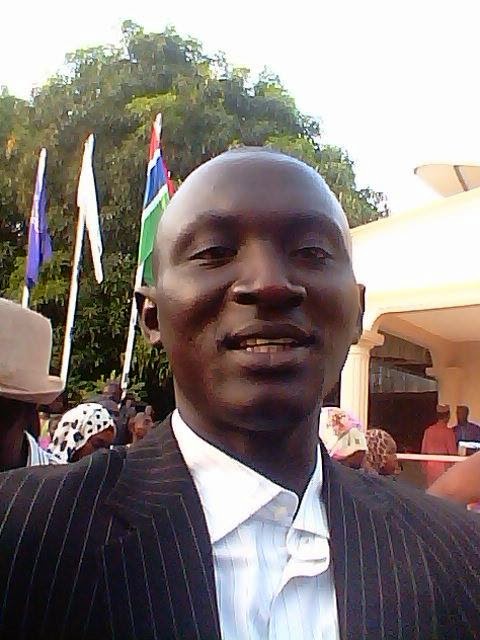

“This year, the target given to GRA is D19.2 billion and at the end of August, we collected D13.8 billion,” the Commissioner General of GRA, Yankuba Darboe, revealed in an interview with Coffee Time With Peter Gomez on Tuesday.

“On average when we look at that, it means we have to collect every month D1.4 billion so that we’ll be able to reach the target given to us,” CG Darboe added.

According to the Gambia’s revenue collection chief, the GRA collected close to two billion Dalasi in July of this year.

“In August, we collected over D1.4 billion. From January 2023 up to the end of August, the overall collection was D10.7 billion. In the same period in 2024; from January to the end of August, we collected D13.8 billion. If you minus that from the same period last year, you have over D3.1 billion as an increase in tax,” enthused the GRA boss.

CG Darboe said the Revenue House is turning every stone to push forward its reform

agenda.

“We are thinking everything humanly possible to push the reforms because without reforms we cannot have this increase of over D3.1 billion as compared to the same period last year,” stated Darboe. He continued:“So, the more reforms we bring in, the more revenue we have for The Gambia. We don’t have much tax increase. The reforms would reduce leakage and promote efficiency. So, I would say the increase is because of our efficiency in collection as a result of the reforms. The collection is progressing because we are involved in making tax reforms in this country.

“So, we are moving gradually. Every other time, you see we come up with something. Every other time, you see we come up with something new. Because of those reforms, we are making a revolution in terms of the collection. We are not necessarily making increase in tax all the time but we are bringing reforms to make sure that the revenue increases and we reduce the leakage. We will continue doing that.”