By: Momodou Justice Darboe

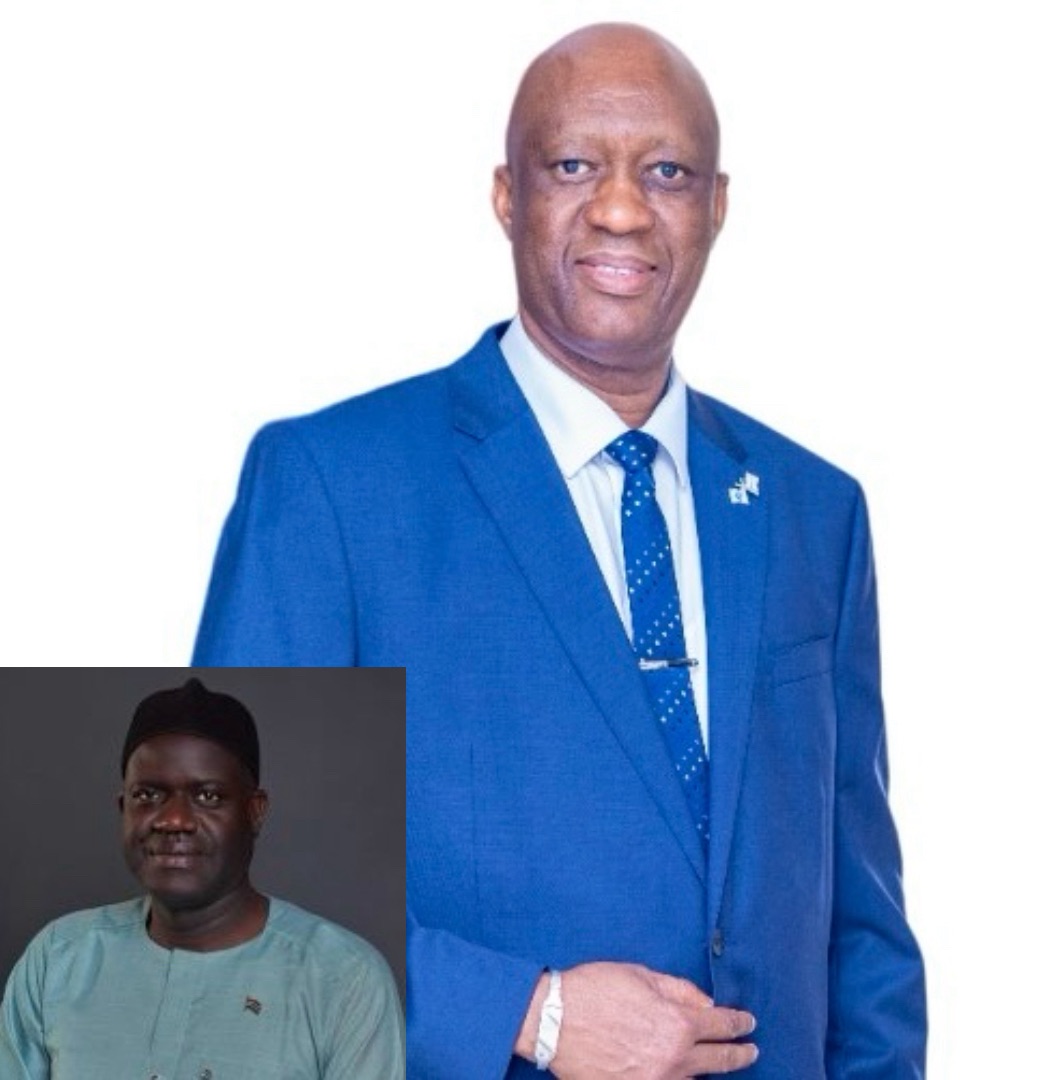

The Commissioner General of the Gambia Revenue Authority (GRA), Yankuba Darboe, has asserted that The Gambia is surviving on Value Added Tax (VAT) thanks to the instrumentality of Dr. Njogu Bah.

Almost 11 years on, the Gambia’s revenue collection boss recognized the instrumental role that Dr. Bah played in sustaining the GRA’s VAT reform agenda.

Commissioner General Darboe acknowledged the bravery and courage of Dr. Bah in bravely lending support to the GRA when it introduced VAT in 2013.

Before the introduction of VAT, the GRA was collecting sales tax for years but thanks to the consultation with ECOWAS and other stakeholders, it came up with the idea of introducing VAT.

“As you know, VAT is considered an indirect tax while sales tax is a direct tax. And then VAT is shouldered bythe taxpayer and cannot be transferred to a consumer/ customer. It’s the consumers that pay VAT and VAT is more transparent than sales tax in terms of calculation and revenue,” explained CG Darboe in an interview with Coffee Time With Peter Gomez yesterday.

However, according to Darboe, when the GRA was finally prepared to migrate from sales tax to VAT, it received pushback from some members of the business community, leading to an executive directive for its immediate stoppage.

“When we started this, we did the works. We changed our books, our systems, everything…Now just to start implementing the strategy, some businessmen went to the former President [Yahya Jammeh] and told him that “do not listen to these boys because they are going to make your country difficult” and the former President asked the former secretary-general, who was no other person than Dr. Njogu Bah, the current director general of PURA, to talk to GRA and the ministry of finance to stop moving from sales tax to VAT with immediate effect,” Darboe recalled.

The GRA boss recollected that Dr. Bah had to go back to Mr. Jammeh after a few days to tell him: “Sir, can you give us the opportunity to run this for three months and see what it is going to be. If it doesn’t work, then we can go back to sales tax. If it works, then we will give you the result.”

“Thank God, the[former] President agreed with him and told him that everything is with you. He told him that if it goes wrong, heads would roll,” Darboe stated.

“We all know how Yahya Jammeh was. Dr. Bah said to him no problem and he would take it up with his people. He called us, including the finance minister and explained the situation. We told him that this is going to be a positive change and within three months, we doubled the collection that used to happen with sales tax,” the GRA boss reminisced.

According to CG Darboe, GRA rakes over D5 billion from VAT, annually.

“So, if we have good people in this country who can stand, no matter how difficult the situation is… They can stand to the authorities to tell them that this is a good reform. And this is what Njogu Bah did. We are surviving on VAT because of Njogu Bah,” Darboe stressed.