By: Kemo Kanyi Dr. Joof

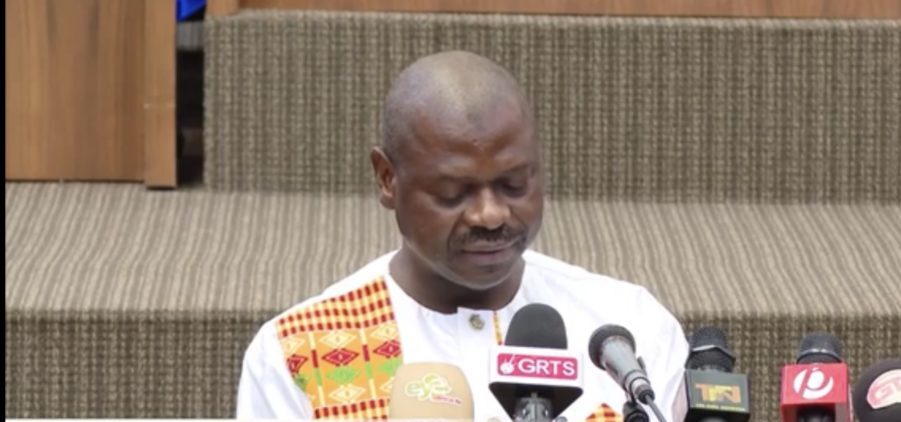

Economist Dr. Foday Joof has said the Gambia’s inflation is rooted in deeper structural deficiencies, hence the ineffectiveness of monetary policy tools to address it.

“Unlike advanced economies where inflation is often driven by excessive money supply, the Gambia’s inflation is rooted in deeper structural deficiencies. Consequently, monetary policy tools like interest rate hikes are largely ineffective in addressing the problem,” he added.

Dr. Joof, a resource economist and sustainable finance specialist, admitted that inflation is a persistent concern for many economies including The Gambia, stating that the Central Bank of The Gambia (CBG) has employed various measures, including interest rate adjustments to curb inflationary pressures. He pointed out that despite these efforts, inflation remains “stubbornly” high. “Inflation and money supply exhibited divergent trends, with inflation continuing to increase even during episodes of low money growth. This suggests inflation in The Gambia is driven by factors other than money supply. Inflation trends tend to rise even when Monetary Policy Rate (MPR) remains relatively high, suggesting that external and supply-side factors, rather than domestic liquidity conditions, are driving price increases,” he explained in an exclusive interview with The Voice.

He further explained that the decoupling of inflation from monetary policy reinforces the argument that structural reforms are necessary to address persistent inflationary pressures, adding that despite significant fluctuations in MPR and treasury bill rates, inflation does not respond proportionally, indicating that interest rate adjustments have a limited impact on price stability.

“Treasury bill rates are not responding effectively to changes in MPR, which suggests weak monetary transmission mechanisms. The lack of synchronization between MPR and treasury bill yields highlights inefficiencies in the financial system, limiting the effectiveness of interest rate policy in controlling inflation,” the sustainable financial specialist pointed out.

Gambia’s Heavy Reliance on Imports

Dr. Joof maintained that The Gambia is heavily reliant on imports for essential goods, including food, fuel, and raw materials.

“This dependence means that global supply chain disruptions, exchange rate fluctuations, and external price shocks have a direct impact on domestic prices. When global fuel prices rise or when the dalasi depreciates against major currencies, the cost of imports surges, leading to higher inflation. No amount of interest rate adjustment can resolve this fundamental issue,” he explained.

He lamented that agriculture, which is a significant part of the Gambian economy, suffers from low productivity due to inadequate infrastructure, farming techniques, and vulnerability to climate shocks, saying that the limited domestic production capacity forces the country to rely on imports, making prices susceptible to external influences.

“Without addressing these structural constraints, inflation will continue to persist, irrespective of monetary policy interventions. Exchange rate volatility makes the country’s currency highly susceptible to external socks, structural rigidities in the labour market, supply chain, and logistical challenges,” added Dr. Joof.

He recommended that given the structural nature of inflation in The Gambia, policy solutions must go beyond monetary measures. He went on to say that identifying certain structural reforms such as diversification of the economy, enhancing domestic production, strengthening exchange rate stability, improving infrastructure, and climate adaptation strategies could provide a more sustainable path to price stability, emphasizing that the central bank should use monetary policy primarily as a signalling tool rather than a direct inflation-fighting mechanism.